SFCU Pledges $300,000 In Funding For Impact Project Loans

Published:

December 18th, 2023

By:

Kelli Miller

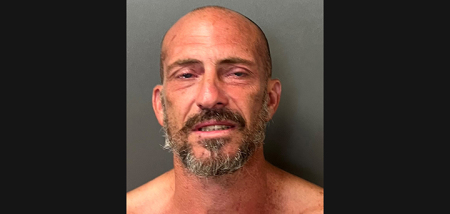

On December 15, The Impact Project and Sidney Federal Credit Union announced a partnership that will see up to $300,000 in loans funded to support low income residents of the tri-counties of Chenango, Delaware, and Otsego. (Photo by Kelli Miller)

On December 15, The Impact Project and Sidney Federal Credit Union announced a partnership that will see up to $300,000 in loans funded to support low income residents of the tri-counties of Chenango, Delaware, and Otsego. (Photo by Kelli Miller)

GREENE - On Friday, December 15, Sidney Federal Credit Union (SFCU) and The Impact Project announced a partnership that will see up to $300,000 in loans funded to support low income resident home repairs.

Funding will include the tri-counties of Chenango, Delaware, and Otsego that fall under the ALICE guidelines (Asset Limited, Income restrained, Employed).

The Impact Project loans are for amounts up to $15,000 for home repairs and charge only 0.5% interest. The goal is to help families maintain and increase equity in their homes and stabilize housing situations through repair and rehabilitation projects.

SFCU President Jim Reynolds said, “There’s no greater testament to the credit union mission of “People Helping People” than the Impact Project. Financial instability is a real problem in the Southern Tier.

He thanked The Impact project Executive Director Jim Willard and team for drawing significant awareness to the housing crisis in the counties.

“We partnered with The Impact Project a few years ago and had 100% success in creating affordable payments for individuals above the poverty level that have no other place to turn,” he said.

“We’re excited about it and supporting projects that rehabilitate homes not only help improve their members’ lives, but also the communities in which they live,” said Reynolds.

He said the credit union model is a financial cooperative with a voluntary board of directors that is locally owned and operated by their members.

He said they are truly vested in our communities and a purpose driven organization that feels there is no better way to give back than with The Impact Project.

Credit was also given to SFCU Vice President of lending Nicole Krom and her department for bringing this need forward.

Willard said, “This $300,000 pledge for 2024 will greatly enhance our capabilities in the next 12 months, not only for the number of people, but the territory of Chenango, Delaware, and Otsego counties.”

“Most of our operations have been in Chenango although we’ve been in six other counties, if fully used, it would be safe to say that this could double what our organization can do in a year,” Willard added.

He said they broke a milestone this year by completing 32 projects and if this all plays out in the next 12 to 13 months, he expects at least 40 and possibly up to 60 homeowners will receive help.

He thanked SFCU, Jim Reynolds, all the staff and crew for the great partnership, his board, the volunteers, and all the businesses that come together that make the Southern Tier a great place to live.

According to Willard, up to a few years ago, The Impact project provided home repairs for homeowners on a free basis. The other level for people over poverty is the A.L.I.C.E. program. He said these are homeowners that have more month than money. They are good people just trying to make it.

“We want them to stay. In Chenango County alone, there are about 10,000 families in houses that are living this way,” he added. “We want to do everything we can.”

Greene resident Gary Quarella gave his thanks to SFCU and The Impact Project for helping with financial lending and the renovations that allowed his wife to return home to safe and supportive surroundings after being hospitalized for nine months.

“Not only did we receive the low interest loan from SFCU but received the financial counseling that we needed to make sure that it worked,” he said.

Willard said the Southern Tier is a great place to live. He said people are simple, kind, and generous with community events, fairs, concerts, and exhibits; all within a half a days drive to Niagra Falls or New York City and back.

“It’s great living and no better place to live,” he said.

Having said that, he explained there is also an undercurrent that’s very negative in the Southern Tier.

Willard said, “It’s called the real housing crisis. 25.2% of all homes are completely vacant, every 48 hours a homeowner picks up and leaves their home. The home is no longer safe and affordable; It doesn’t have heat, nor a solid roof, no running water, and the family leaves.”

He said when they leave, they leave our communities, they no longer buy things in our communities, they leave businesses, they quit their jobs, and they pull their children out of schools.

“The Impact Project is fighting this under current. It’s our main purpose and our main goal,” he said.

Willard said In Chenango County, the average medium household income is just over $30,000 a year and If we lose three families a week, which we are, that’s about 100,000 a week in commerce that leaves this county, about $ 5 million a year. He said Otsego and Delaware Counties are in similar paths, just trailing.

“Our organization is 100% committed to helping people stay in their homes. Home is a very important thing,” he said. “It’s where our family lives, where our security is, where our memories are, where we paint the walls certain colors. It’s our home.”

Willard said since 2004 the Impact Project, an independent faith based organization, has completed 192 projects in seven different counties. He said they will start their 193rd project this week and over the years, 4,231 volunteers gave their time to help homeowners stay in their homes.

The Impact Project is a nonprofit 501c3 based in Greene, NY that provides major home repairs for low income families.

More information on The Impact Project can be obtained by visiting theimpactprojectgreene.org.

SFCU is headquartered in Sidney, NY and is a full-service financial institution providing the tools and resources members need to make banking easy and convenient. More information can be found at www.sfcuonline.org.

Author: Kelli Miller - More From This Author

Comments