Afton Central School District Plans To Reduce Surplus In Undesignated Fund Balance

Published:

July 11th, 2023

By:

Kelli Miller

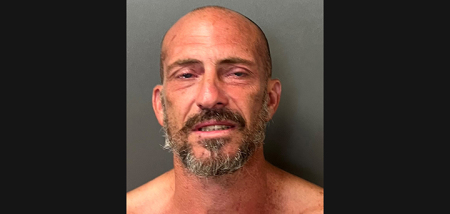

Afton School Board Superintendent Nicholas Colosi.

Afton School Board Superintendent Nicholas Colosi.

AFTON - The School Board and District officials are working with the New York State Comptroller’s Office to reduce surplus in the fund balance to comply with the statutory limit that may be beneficial to taxpayers.

Afton School Board Superintendent Nicholas Colosi said, “The comptroller’s office does an audit approximately every six to seven years. The last audit was done in 2016 and showed the same thing; the undesignated fund balance was higher than the four percent allowable by the state.”

According to the auditors’ findings, the board of education annually overestimated appropriations from fiscal year 2019-2020 through 2021-2022 by an average of $1.1 million or seven percent. That surplus fund balance exceeded the four percent statutory limit in each of the last three fiscal years by nearly $2.9 million to $5.6 million (31.5 percentage points).

“When I started the position last July, the fund balance was higher than normal. Talking with the business official we had already identified this,” he added.

Colosi explained they looked at some things the district needed for safety and security and found the buses didn’t have radios so they allotted monies for that.

They also moved undesignated funds into some of the designated categories for retirement codes such as the Early Retirement System (ERS) and Teachers Retirement System (TRS). They did this back in October just about the same time the comptroller’s office went in to audit.

“There wasn’t a corrective action plan at that time; it was a fund balance management plan, which in turn is becoming our corrective action plan,” said Colosi.

“The undesignated fund balance goes into the undesignated fund account; extra money you didn’t spend.

There is also a designated fund balance where you put money to pay for other things, capital projects, retirement codes, etc,” he said. “There is a difference between the two. The comptrollers were talking about the undesignated fund balance.”

Colosi further explained they don’t know what happened between the last audit and the current one. The current business official was hired a year ago in March and has only been there about a year and a half and all of the administrators are new to their positions in the district and have a lot to learn.

“Over time there was a downturn in the economy and budgets and funding, so I know they were trying to reserve some funds for those rainy days. For capital improvements, equipment malfunction purchasing, etc,” Colosi said.

He explained the comptrollers did their audit and Identified there was a fund balance issue. To combat that, they did a corrective action plan.

“Also in the last budget, we voted to create two new capital reserves that start fundings for future projects and the purpose there will be to use some of that fund balance to do projects that will have no additional impact on the tax payers. Basically, turning the money into a future project to improve the district and to not raise taxes,” he added.

Colosi said they had problems with students vaping in the bathrooms so they installed vape sensors in the middle and high school bathrooms. Asphalt was failing in some areas so they made a plan to use some of that fund balance to do the maintenance work and they are also planning on funding their own bus purchases to not pay interest on a loan.

“Some of the things that make district budgeting difficult, for example, is state aid and how much we’re going to get,” said Colosi.

“Also, being a small district, one or two students with special education needs, sometimes those students can cost well over a quarter million dollars per student,” he said. “You have to budget for some extra things that might come up and sometimes you don’t spend it and other times you do.”

“Right before school started and after the budget passed, we had six special education students move into the district, so we had to hire another special education teacher to make those accommodations,” he added.

Colosi said it’s not as black and white as they would like but they are trying to plan accordingly. As they move through the budget process, they will try and make sure they don’t put too much buffer in and will use that fund balance from the past to keep the burden less on tax payers.

No funds were placed into any private accounts. All funds were from the district funds and extra from the general fund that wasn’t spent.

The school district submitted an acknowledgment of their findings of their report and the next step will be at the next board meeting this coming Thursday. The board will approve a corrective action plan based on the Comptroller’s recommendation and send it back to the Comptroller’s office. The full report and corrective action plan will be published.

The tax payer can find the report on the Comptroller’s web page and once board approved it will be on Afton School District web page.

Colosi said this didn’t happen over night; the fix won’t happen overnight because they want to be fiscally responsible and being they’re a small district, one or two maintenance items can have a huge impact on the budget. For example, they used some of the extra fund balance for a generator in the newly built bus garage. The purchase didn’t impact anyone because the funds were there, creating a win-win in terms of the district.

“That purchase didn’t impact anyone and at the tune of a couple hundred thousand dollars that’s not money you typically have sitting aside. It’s almost like that rainy day fund,” he said. “ In school finance, it works a little different in terms of state aid. They want you to have debt. And if you don’t have debt, it impacts how much you get. We’re trying to balance what we have in reserves and what we have in tax cap.”

Colosi said, “Our philosophy when it comes to taxes is trying to keep them stable, when your debt is stable the tax cap is stable. There aren’t the peaks and valleys because people would love a zero percent tax levy, however, that can impact future years to go much higher than the approximate two percent tax cap.”

“It’s all part of our budgeting process and our forecasting for future fund balance and tax levies because one year can impact several years in the future. Putting all of this together to be as fiscally responsible as possible,” He added. “ We want to be as transparent as possible, we’re here to answers questions and do the right thing. We’re aware of the budget issues and we’re working on it.”

The District serves the towns of Colesville and Sanford in Broome County and the towns of Afton, Bainbridge, and Coventry in Chenango County. The District is governed by five elected board members who are responsible for managing and controlling the financial and educational affairs. The Superintendent is the District’s chief executive officer and responsible for the District’s daily management under the Boards direction.

Author: Kelli Miller - More From This Author

Comments