Special Report: Natural Gas And Economic Development In The Southern Tier

Published:

December 2nd, 2011

By:

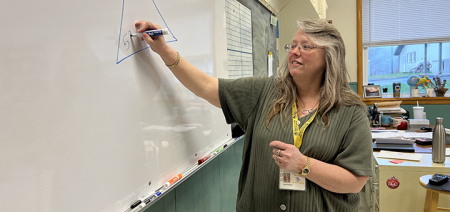

Melissa deCordova

In the first part of this series, printed yesterday in The Evening Sun, Chenango County Economic Development Consultant Steven Palmatier outlined two scenarios, with several caveats each, that described the role natural gas will play in our region’s economic growth. His report was requested by the Southern Tier Regional Economic Development Council – a council that is competing for $1 billion in grants, tax credits and other funding sources that Governor Andrew Cuomo plans to award next year. (Since then, Cuomo and his New York Open for Business councils have decided not to consider regions’ specific natural gas strategies. Doing so would “prejudge the experts who are defining the state’s permitting process,” they say.)

Here is the third scenario that may play out would be the development of the natural gas in the tight shales that lie under portions of Central New York.

By Steven Palmatier

Chenango County Economic Development Consultant

With the release of the second draft of the SGEIS followed by the current public comment period, it is possible that the DEC may issue some permits to drill shale wells in the first quarter of 2012. If this were to occur, the economic impact over the next five years could be significant.

Positive economic impacts might include:

• Additional leasing with bonus payments being made to the owners of the rights to the minerals within the shale. Based on recent leasing activity in the region, payments of up to $3,000 per acre would not be unexpected.

• Royalties would be paid to landowners from wells drilled into the Marcellus Shale. Even if natural gas prices remain at their current levels of around $4.00 per MCF the royalties from a single Marcellus well could total from between $500,000 and $750,000 per year. [According to the dSGEIS: “Depending on the geology, a typical horizontal well in the Marcellus Shale (covering approximately 80 acres) may produce 1.0 to 1.5 billion cubic feet of gas cumulatively over the first five years in service. At a natural gas price of $6 per thousand cubic feet, a 12.5 percent royalty could result in royalty income to a landowner of $750,000 to over $1 million over a five year period.”]

• There will also be a significant positive impact on revenues to the local taxing entities where the wells are located. Although the formula on which the ad-valorem tax in New York is based is somewhat complicated, it appears based on work done by the Chenango County Natural Gas Advisory Committee, that the tax works out to approximately a 6 percent tax on production. At that rate of taxation, each well would produce between $250,000 and $375,000 (at the $4.00 mcf price) of tax revenue, all of which remains local, during the first five years of the well’s production. Since each pad will theoretically have between six and 10 wells drilled from it, with all wells being drilled within three years (dSGEIS) this revenue stream could have a major impact on local budgets for some period of time.

[Additional estimates of revenues to both the state and local governments through income and sales taxes are available in the addendum to the dSGEIS released in September of 2011. This same addendum also contains estimates of employment figures based on various scenarios of the development of the Marcellus Shale in the state.]

Since it is not at all clear, however, if or when the final draft of the SGEIS will be released and permits issued, we should consider the opportunities presented by the first two scenarios.

Seek out industry suppliers, develop business parks

If there is not a local business that is able or willing to meet the needs of the industry, we should be actively seeking a supplier from outside the area to locate here. There is also an entire manufacturing and repair industry that supplies the natural gas drillers and producers (well head apparatus, meters, drill pipe repair, drill bit repair and remanufacturing, etc.). Manufacturers of those products who do not already have a regional facility should be contacted and encouraged to locate in New York.

Several industrial parks should be developed along the I-86 corridor to accommodate these suppliers. It has been my observation that when these companies want to site a facility they wish to move quickly.

Industrial parks should be developed to take advantage of the locally produced gas. Whether supplied by a public utility (the Leatherstocking Gas LLC model) or released to an agency such as an IDA or municipal power company (the Jamestown and Hamilton models), natural gas can be supplied at costs that are 15 to 20 percent lower than the cost of gas transported through interstate pipeline. Both Bainbridge and Greene in Chenango County come to mind immediately as sites although there are certainly other opportunities in the region. This could lure some companies who have been scared to locate to New York due to our high energy costs to move here.

Several pilot projects should be developed using natural gas to power municipal vehicles. At the current ratio of natural gas vs. gasoline or diesel prices, natural gas is as much as 60 percent less as expensive as either of the other two fuels. There is an excellent opportunity to lower costs to local government and reduce our use of foreign oil by using natural gas as a vehicle fuel. The savings would be even greater if the gas were locally produced.

In the same vein there is a significant opportunity to lower costs to local farmers by converting gas and diesel powered farm equipment to natural gas where a supply is available. Those farms in the region that have a natural gas supply should be located and partial funding for the conversions should be made available to convert the equipment.

Mothballed coal-fired power plants should be converted or reconstructed to burn natural gas or a combination of natural gas and biomass.”

Educate, train potential workforce

The job skills needed by the industry should be identified and those educational institutions best suited to teaching those skills should develop programming should do so. Sources of information on the skills needed could come from IOGA, IADC (the Rig-Pass program), the ShaleNET consortium, MSTEC and Petroskills. There are opportunities here to quickly develop or expand training programs for the “blue collar” jobs the industry creates at our BOCES facilities while our schools of science and engineering develop programs to teach the more highly valued skills the industry needs.

Our region’s depth of educational institutions makes it an ideal location to develop programs that would allow employees of the industry to continue to expand their skills throughout their career.

Melissa deCordova edited this series.

Author: Melissa deCordova - More From This Author

Comments